Have you ever wondered if mold inspection in Tucson is covered by your homeowners’ insurance? This article will provide you with all the information you need to know about the coverage for mold inspections in Tucson. Whether you have concerns about the potential presence of mold in your home or are looking for guidance on insurance coverage, we’ve got you covered. Discover how your homeowners’ insurance policy can protect you and your home from the potential damages and costs associated with mold inspections in Tucson.

What is mold inspection?

Definition of mold inspection

Mold inspection is the process of assessing a property for the presence of mold growth and identifying the potential sources of moisture that may be causing or supporting its growth. Mold inspections are typically carried out by professionals who are trained to recognize the signs of mold infestation and assess its extent. These inspections are crucial for early detection and prevention of mold-related issues in homes and buildings.

Purpose of mold inspection

The primary purpose of mold inspection is to ensure the safety and well-being of the occupants of a property. Mold can pose significant health risks, especially for individuals with respiratory conditions or weakened immune systems. By conducting a mold inspection, potential health hazards can be identified early on, and appropriate measures can be taken to mitigate or eliminate mold growth.

Process of mold inspection

During a mold inspection, a qualified professional will thoroughly examine the property, both visually and using specialized equipment. They will look for visible signs of mold, such as discoloration or black spots on walls or ceilings. They may also use moisture meters or thermal imaging cameras to detect hidden moisture sources that could be contributing to mold growth. Samples may be collected for laboratory testing to confirm the presence of mold and identify the specific type of mold present. The inspection process may also involve assessing the overall indoor air quality and ventilation system to ensure that mold spores are not being circulated throughout the property.

Importance of mold inspection

Health risks associated with mold

Mold growth in indoor environments can lead to a variety of health issues. Exposure to mold spores can cause allergic reactions, respiratory problems, asthma attacks, and even serious infections in some cases. Those with pre-existing health conditions, the elderly, and young children are particularly vulnerable to the adverse effects of mold exposure. By conducting routine mold inspections, homeowners can identify and address mold growth before it becomes a serious health threat to their family.

Preventing property damage

In addition to the health risks, mold can cause significant damage to a property if left untreated. Mold growth often indicates the presence of excessive moisture or water damage, which can weaken the structural integrity of the building and lead to costly repairs. Mold can also cause damage to personal belongings, furniture, and fixtures. By regularly inspecting for mold, homeowners can identify and address moisture issues early on, reducing the risk of extensive property damage.

Identifying potential sources of mold growth

During a mold inspection, professionals will not only identify the presence of mold but also determine the underlying causes of mold growth. This can include issues such as leaks, inadequate ventilation, or high humidity levels. By identifying and addressing these potential sources of mold growth, homeowners can effectively prevent future mold infestations and create a healthier living environment.

Homeowners’ insurance coverage for mold inspection

Types of homeowners’ insurance policies

There are several types of homeowners’ insurance policies, each offering different levels of coverage and protection. The most common types include:

- HO-1: This is a basic form of coverage that provides limited protection for specific named perils, such as fire or theft.

- HO-2: This is a more comprehensive policy that covers a broader range of perils, including certain types of water damage.

- HO-3: This is the most common and widely used homeowners’ insurance policy. It provides coverage for most perils except those specifically excluded in the policy.

- HO-4: This is a renters insurance policy designed for tenants who do not own the property they live in.

- HO-6: This is a policy specifically designed for condominium owners, providing coverage for both the individual unit and personal belongings.

- HO-8: This policy is intended for older homes and provides coverage based on the actual cash value of the property, rather than the replacement cost.

Coverage for mold-related issues

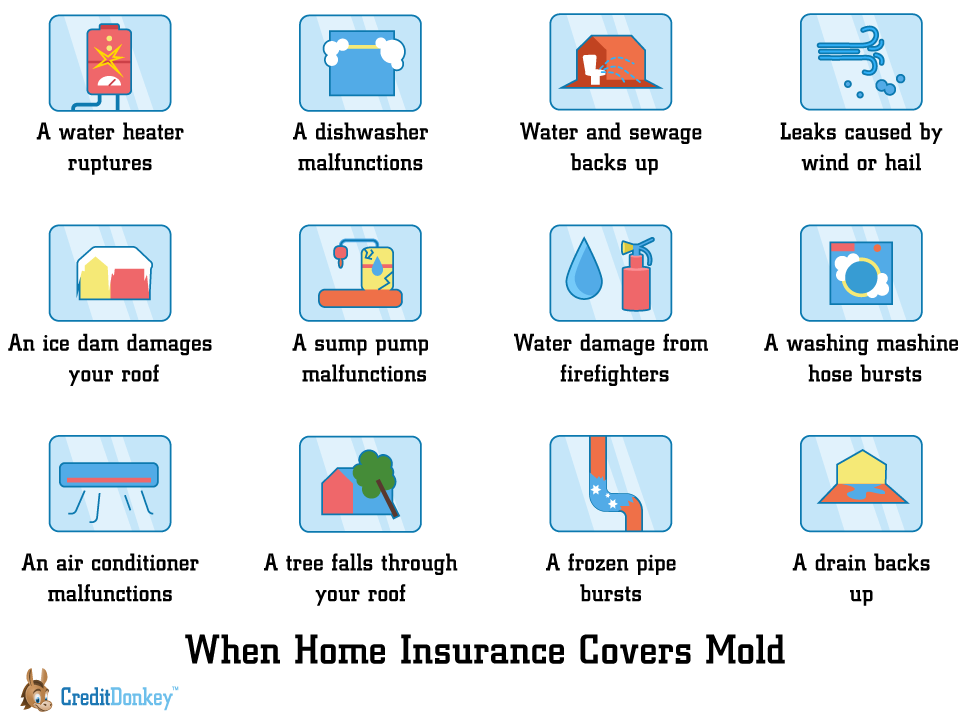

The coverage for mold-related issues varies depending on the specific homeowners’ insurance policy. In general, standard homeowners’ insurance policies do not provide coverage for mold damage or mold inspections. However, some policies may offer limited coverage for mold damage resulting from a covered peril, such as a burst pipe or storm damage. It is essential to review your policy carefully or consult with your insurance agent to understand the specific coverage provided for mold-related issues.

Exceptions and limitations

Even if a homeowners’ insurance policy includes some coverage for mold-related issues, there are typically exceptions and limitations. For example, coverage may be limited to a specific dollar amount or subject to a separate deductible. Additionally, some policies may exclude coverage for mold damage resulting from certain circumstances, such as flood-related mold damage or mold caused by lack of maintenance. It is crucial to read the policy terms and conditions carefully to understand any exclusions or limitations that may apply.

Factors affecting insurance coverage

Age and condition of the property

The age and condition of the property can influence insurance coverage for mold inspections. Older homes are more likely to have underlying issues such as plumbing leaks or inadequate ventilation systems, which can increase the risk of mold growth. Insurance providers may consider the age and condition of the property when underwriting a policy and determining the coverage offered for mold-related issues.

Prior mold-related claims

If a homeowner has made previous mold-related claims, insurance providers may view the property as a higher risk. This could lead to higher premiums or more limited coverage for mold-related issues. Insurance companies may consider the homeowner’s claims history, including the frequency and severity of previous mold claims, when determining coverage eligibility and rates.

Location and climate

The location of a property and the climate in that area can also impact insurance coverage for mold inspections. Certain regions may be more prone to high humidity levels, flooding, or other conditions that contribute to mold growth. Insurance providers may take these factors into account when offering coverage and setting premiums. Homeowners in high-risk areas should be particularly diligent in understanding their insurance coverage and taking preventive measures against mold growth.

Insurance policies that may cover mold inspection

Comprehensive homeowners’ insurance

While mold inspections are not typically covered by homeowners’ insurance, a comprehensive homeowners’ insurance policy may include some coverage for mold damage resulting from a covered peril. It is essential to review the terms and conditions of the policy or consult with your insurance agent to understand the extent of the coverage provided.

Additional endorsements or riders

Homeowners who are concerned about mold-related issues can consider adding endorsements or riders to their insurance policies to enhance their coverage. These additional policy provisions can provide more comprehensive protection for mold damage and may also include coverage for mold inspections. Adding an endorsement or rider to your policy can provide added peace of mind and ensure that you have adequate protection against mold-related issues.

Special insurance policies for high-risk areas

In areas prone to frequent and severe mold issues, insurance companies may offer specialized insurance policies that provide enhanced coverage for mold-related issues. These policies may be more expensive but can provide specific protection and higher limits for mold damage and inspections. Homeowners in high-risk areas should inquire with insurance providers about these specialized policies to determine if they offer better coverage options for their specific needs.

Exclusions and limitations of insurance coverage

Mold caused by lack of maintenance

Most homeowners’ insurance policies exclude coverage for mold damage resulting from a lack of maintenance. If mold growth is determined to be the result of neglecting necessary repairs or failing to address underlying moisture issues, insurance providers may deny a mold-related claim. It is crucial for homeowners to regularly inspect and maintain their properties to prevent mold growth and ensure that they meet their insurance policy’s maintenance requirements.

Gradual or continuous water leaks

Insurance policies typically exclude coverage for mold damage resulting from gradual or continuous water leaks. This means that if a mold problem is caused by a slowly leaking pipe, a faulty appliance, or any other long-term water source, the insurance claim for mold damage may be denied. It is essential to promptly address any water leaks or plumbing issues to prevent mold growth and potential claim denials.

Flood-related mold damage

Most homeowners’ insurance policies do not provide coverage for mold damage resulting from floods. Flood insurance is a separate policy that can be purchased through the National Flood Insurance Program (NFIP) or private insurance companies. If you live in an area prone to flooding, it is essential to obtain flood insurance to protect your property against flood-related mold damage.

Steps to take when filing a claim

Contacting the insurance provider

If you discover mold in your property and believe it may be covered by your insurance policy, the first step is to contact your insurance provider. Report the mold problem and discuss the details of your policy coverage with an agent. They will guide you through the claims process and provide you with the necessary forms and documentation requirements.

Documenting the mold problem

When filing a mold-related insurance claim, it is crucial to document the problem thoroughly. Take photographs or videos of the mold growth and any associated damage. Keep records of any remediation efforts or costs incurred to address the mold issue. Detailed documentation will help support your claim and ensure you have the necessary evidence to demonstrate the extent of the damage.

Cooperating with the insurance company’s investigation

Once you have filed a mold-related insurance claim, the insurance company will initiate an investigation. This may involve sending an adjuster to inspect the property, review the documentation you provided, and assess the extent of the mold damage. It is important to cooperate fully with the insurance company’s investigation and provide any additional information or documentation requested. This will help facilitate a smoother claims process and increase the likelihood of a successful claim outcome.

Alternative options for mold inspection coverage

Stand-alone mold insurance policies

While mold inspections are typically not covered by homeowners’ insurance, stand-alone mold insurance policies are available in some cases. These policies specifically cover mold-related issues, including the cost of mold inspections, remediation, and repairs. Stand-alone mold insurance policies can provide an alternative option for homeowners who want comprehensive coverage for mold-related issues beyond what is typically included in standard homeowners’ insurance policies.

Home warranty plans

Some home warranty plans include limited coverage for mold-related issues. Home warranty plans typically cover the repair or replacement of major home systems and appliances due to normal wear and tear. While coverage for mold damage may vary, homeowners who have a home warranty plan may have some level of protection for certain mold-related issues. It is important to review the terms and conditions of the home warranty plan to understand the extent of the coverage provided.

Government assistance programs

In certain situations, homeowners may be eligible for government assistance programs to help address mold-related issues. These programs are typically available in areas affected by natural disasters, such as hurricanes or floods, where widespread mold growth may occur. Local or state government agencies can provide information on available assistance programs and eligibility criteria.

Costs associated with mold inspection

Average cost of mold inspection in Tucson

The cost of mold inspection in Tucson can vary depending on various factors, such as the size of the property, the extent of the mold problem, and the complexity of the inspection. On average, homeowners can expect to pay between $300 and $600 for a comprehensive mold inspection in Tucson. It is important to obtain multiple quotes from reputable mold inspection professionals to ensure a fair price and quality service.

Factors influencing the cost

Several factors can influence the cost of mold inspection in Tucson. These include the size of the property, the accessibility of the affected areas, the number of samples collected for laboratory testing, and the level of expertise and reputation of the mold inspection professional. Additionally, if additional services such as moisture mapping or air quality testing are required, the cost may be higher. It is recommended to discuss the specific details of the mold inspection with professionals to obtain accurate cost estimates.

Potential reimbursement through insurance

While mold inspections are typically not covered by homeowners’ insurance, if the mold problem is related to a covered peril, there may be an opportunity for reimbursement through the insurance claim. The cost of the mold inspection itself may not be reimbursed directly, but if the mold damage is confirmed, the cost of remediation and repairs may be covered. It is important to consult with your insurance provider and follow the claims process to determine if you are eligible for any reimbursement.

Preventing mold growth and minimizing insurance claims

Maintaining proper indoor humidity levels

One of the most effective ways to prevent mold growth is by maintaining proper indoor humidity levels. Keep indoor humidity between 30% and 60%, as higher humidity provides an ideal environment for mold to grow. Use dehumidifiers in high-humidity areas such as basements or bathrooms and ensure adequate ventilation throughout the property. Proper humidity control can significantly reduce the risk of mold growth and minimize the need for insurance claims related to mold damage.

Promptly addressing water leaks or moisture issues

Water leaks or moisture issues should be promptly addressed to prevent mold growth. Regularly inspect your property for any signs of leaks, such as dripping faucets or water stains. Fix any plumbing leaks or roof issues immediately. If water damage occurs from a burst pipe or other covered peril, contact your insurance provider and document the damage for possible mold-related insurance claims. Taking swift action to address water leaks will help minimize the risk of mold growth and potential property damage.

Regularly inspecting and maintaining the property

Regular inspections and maintenance of the property are essential for preventing mold growth. Pay attention to areas that are prone to moisture, such as basements, bathrooms, and kitchens. Clean and dry these areas regularly and ensure proper ventilation. Regularly inspect your property’s roof, gutters, and plumbing systems to identify and address any potential sources of water damage. By staying proactive and maintaining your property, you can greatly reduce the likelihood of mold growth and the need for mold-related insurance claims.

In conclusion, mold inspection is a crucial process for homeowners to ensure the safety of their property and the health of their family. While mold inspections are typically not covered by homeowners’ insurance, understanding the coverage provided for mold-related issues is essential. By addressing moisture issues, regularly maintaining the property, and taking preventive measures, homeowners can minimize the risk of mold growth and potential property damage. Exploring alternative options such as stand-alone mold insurance policies or government assistance programs may provide additional coverage for mold-related issues. By prioritizing mold prevention and staying proactive, homeowners can create a healthier living environment and protect their property from the damaging effects of mold.